Sales typically fall from June to July as house hunters and real estate agents head off on vacation, but the average drop-off since 1988 has been only 6 percent. The number of homes sold last month was the lowest for a July since 2011. CoreLogic attributed the sharp slowdown to “a tight inventory and waning affordability.”

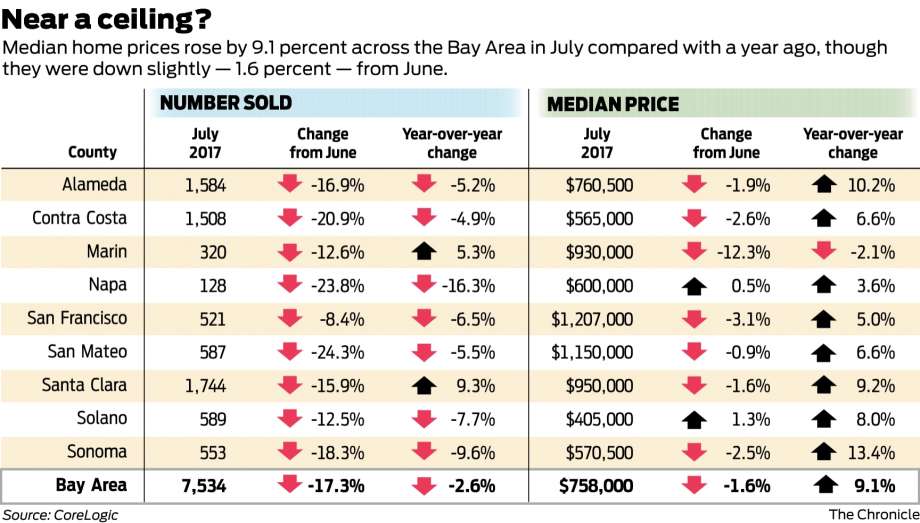

Meanwhile, the median price paid for a home in the nine-county region last month was $758,000, down 1.6 percent from a record $770,500 in June, but up 9.1 percent year over year. The report includes new and existing single-family dwellings and condos.

More from Kathleen Pender

-

File one too many flood claims and you could be in for a nasty

-

New California law aims to stop spread of bedbugs

-

Fannie, Freddie to waive appraisals on some purchase loans

Vacations also cause prices to dip from June to July; the long-run average is a 0.2 percent decline. For buyers, the slightly larger-than-average price decline last month will provide little solace.

Only 21 percent of households in the Bay Area could afford a median-priced home in the second quarter, according to the California Association of Realtors’ affordability index. That’s down from 25 percent in the first quarter. The index estimates the percentage of households that have the minimum income needed to buy an existing, median-priced single-family home with a 20 percent down payment at prevailing mortgage rates. It does not include condos, which tend to be cheaper than single-family homes.

By the association’s reckoning, a Bay Area buyer would need $179,390 in annual income to buy the median-priced home.

Home prices are soaring because the region’s supply of new housing is not keeping up with demand, which is fueled largely by job growth, especially in high-paying technology jobs.

However, even at tech companies, most employees are not making enough to buy a median-priced home, Katie Ferrick, director of community affairs at LinkedIn, said at a housing conference in San Francisco last week sponsored by the Center for California Real Estate and Bay Area Council. At LinkedIn, the “vast majority” of workers are not making $179,000, she said.

The state’s least-affordable county is San Francisco, where only 12 percent of households could afford the median-priced home in the second quarter. But it has been worse. In 2005, when incomes were lower and mortgage rates higher, the index was 8 to 9 percent. Its recent high was 29 percent in early 2012.

Finding an entry-level home in the city is getting nearly impossible, according to a study out this week by the San Francisco Association of Realtors.

Last month, there were only 140 homes and condos in the city listed at less than $758,000, it said. In July 2014, there were 367 homes listed below $758,000. Over those three years, the average household income for a family of four in San Francisco rose 15.7 percent, but the median home and condo price rose 25 percent.

“The most competitive price point is the single-family home under $1.5 million,” said Drew Wilkerson, an agent with Vanguard Properties. Last week, he filmed an episode of the HGTV show “House Hunters” with a couple searching in that price range in San Francisco.

His clients had written three previous offers before buying a three-bedroom, 1.5-bath place in Merced Heights for $1,090,000. The couple, who have two young children, both work full-time, but not in tech. Like many first-time buyers, they got help with the down payment from parents, Wilkerson said.

One of the homes they visited was 415 Amazon Ave. in the Excelsior district. The home has two bedrooms, two baths and 1,155 square feet. It’s listed at $899,000. Traffic at two open houses last weekend “was absolutely constant,” said listing agent James Belisle, also with Vanguard. On Sunday, “there were 10 people waiting to get in at 2 o’clock.”

Most of the housing — both rental and for sale — being built in the Bay Area is either below-market rate or high end. People who earn too much to qualify for the former and too little to afford the latter are often forced into “mega commuting” or “driving till you qualify,” Carol Galante, faculty director at UC Berkeley’s Terner Center for Housing Innovation, said at last week’s conference.

A package of bills aimed at easing the state’s housing shortage could come up for a vote in Sacramento this week. But none is aimed at what Galante calls the “missing middle.”

One would create a new recording fee on certain real estate documents to fund low-income and affordable housing. One would ask voters to approve $4 billion in bonds, mainly for low-income rental housing but also for the state’s veteran home loan program, which could help middle-income vets, Galante said.

The third “basically requires that localities streamline their development-approvals process for communities that aren’t meeting their regional needs formula,” Galante said in an interview. This could open the door for some middle-income housing, but it applies to a very limited range of projects.

Galante said middle-income buyers and renters don’t have the same type of advocacy groups that champion low-income housing.

Of course, any new housing — high or low end, for sale or rent — eventually will relieve pressure on middle-income buyers.

Galante and other speakers at the conference said the state should do more to overcome the barriers to development erected at the local level, such as utility and impact fees.

Because Proposition 13 limits property tax increases, local governments put much of the cost of providing services on developers, which discourages new housing. The state also should consider creating incentives for housing by redistributing sales and property taxes and transportation dollars for communities that are meeting their goals, she said.

Kathleen Pender is a San Francisco Chronicle columnist. Email: kpender@sfchronicle.com Twitter: @kathpender

Article source: http://www.sfchronicle.com/business/networth/article/Finding-starter-homes-a-tall-order-in-the-Bay-Area-12162525.php